mobile al vehicle sales tax

Additionally local county taxes can be applied as well up to about 4 percent depending upon the county. Address and daytime phone number.

Honda Accord Cl9 2006 An Owner S Review Honda Accord Honda Performance Cars

Lowest sales tax 5 Highest sales tax 115 Alabama Sales Tax.

. Revenue Forms and Applications. 251 574 - 1899. Online Filing Using ONE SPOT-MAT.

The 2018 United States Supreme Court decision in South Dakota v. The Mobile County sales tax rate is. Compared to other states Alabamas state auto sales tax rate is modest at 2 percent of the purchase price.

Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7. There are a total of 290 local tax jurisdictions across the state collecting an average local tax of 4007. Sales Tax The state sales tax on automotive vehicles is 2 percent of the gross proceeds of the sale.

251 574 - 8103 Fax. Property taxes are based on the make model and age of the vehicle. Motor vehicles are registered through license plate issuing offices in the county in which the owner resides.

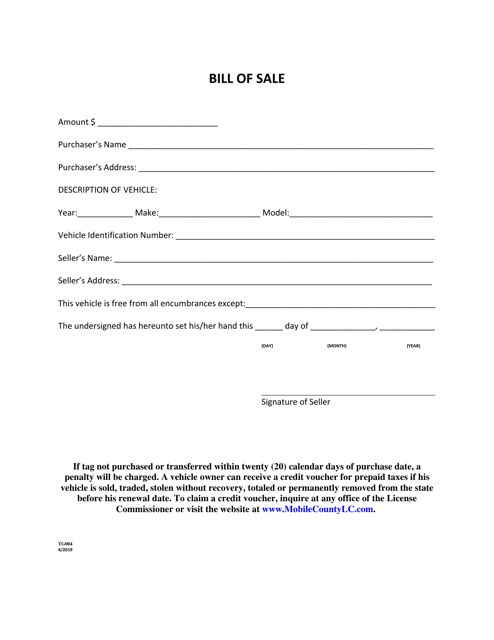

Anderson acquires a vehicle on January 5 2009 during his renewal month. The minimum combined 2022 sales tax rate for Mobile County Alabama is. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100.

The actual sales tax may vary depending on the location as some countiescities charge additional local taxes. The Alabama state sales tax rate is currently. What is the sales tax rate in Mobile Alabama.

If you have questions please contact our office at. A breakdown of local tax rates can be found on the Sales Tax Rates publication from the Alabama Department of Revenue. This is the total of state county and city sales tax rates.

The Alabama sales tax rate is currently. Mobile AL 36652-3065 Office. The partial tax due will be the state sales tax of two percent 2 not to exceed the amount of tax that would have otherwise been due on the vehicle in the state in which the nonresident will title or register the vehicle for first use.

4 rows Mobile AL Sales Tax Rate. Code of Alabama Section 40-23-24. For Tax Rate at a Specific Address click here.

This is the total of state and county sales tax rates. NOTICE TO PROPERTY OWNERS and OCCUPANTS. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information.

According to the Alabama Department of Revenue Alabama charges 2 for auto sales tax. See information regarding business licenses here. Monday Tuesday Thursday Friday.

Average Sales Tax With Local. The Alabama Legislature amended this law to include county and municipal sales and use tax on boat purchases effective on and after July 1 1994. In addition to light duty vehicles an automotive vehicle also includes a truck truck trailer or house trailer.

Alabama has recent rate changes Thu Jul 01 2021. Local sales and use taxes will not apply to these purchases. Motor vehicle registration IFTA and IRP transactions must be submitted electronically.

The current total local sales tax rate in Mobile AL is. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile. With local taxes the total sales tax rate is between 5000 and 11500.

Property taxes must be collected in advance. The Mobile County Sales Tax is 15. In some parts of Alabama you may pay up to 4 in car sales tax with local taxes.

24 rows rental tax. Select the Alabama city from the list of cities starting with A below to see its current sales tax rate. State of Alabama Sales Use Tax Information.

Monday Tuesday Thursday Friday 700am. A county-wide sales tax rate of 15 is applicable to. Section 34-22 Provisions of state sales tax statutes applicable to article states.

If the city resident buys a vehicle from a dealer in a neighboring city and the dealer fails to collect city sales tax then the city resident will pay city use tax at the time of vehicle registration. For additional questions or to schedule an appointment please contact the Motor Vehicle Division at 334 242-9000 or submit an electronic. The state sales tax rate in Alabama is 4000.

2 is the statewide sales tax. Alabama Legislative Act 2010-268. What is the sales tax rate in Mobile County.

The minimum combined 2022 sales tax rate for Mobile Alabama is. The County sales tax rate is. 251 574 - 4800 Phone.

Car Wash Eddm Postcard Template Car Wash Postcard Template Postcard Design

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Local Delivery With A Minimum Purchase Of 1 799 Come By Our Daphne And Mobile Showrooms Today Alittleextra Freedeliver Delivery Daphne Calm Artwork

How To Register A Car In Alabama Yourmechanic Advice

How To Calculate Your Car Detailing Business Income Potential

Used Cars In Mobile Al For Sale

Used Cars Trucks Suvs For Sale In Mobile Al

Static Skynetblogs Be Media 98449 2071108885 Jpg Antique Cars Car Spyder

Motor Home Alabama Department Of Revenue

Vehicle Sales Purchases Orange County Tax Collector

Free Alabama Vehicle Bill Of Sale Forms Fill Pdf Online Print Templateroller

8 Wallpaper Hyundai Tucson 2020 Colors Hyundai Tucson New Hyundai Hyundai

Tax Deducted At Source Is An Indirect System Of Deduction Of Tax According To The Income Tax Act 1961 At The Point Funny Dating Memes Top 10 Jokes Tax Season

Motor Vehicle Alabama Department Of Revenue

Instant Cash Offer Inventory Trade In Tool Kelley Blue Book B2b

Vehicle Flyer Card Holders Monavie Avon Mary Kay Rep Card Box Holder Card Box Card Holder

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price